ASPCA Heroes Circle: Major Giving

Get Involved

Your Impact

The Heroes Circle is the ASPCA’s leading donor group, providing critical philanthropy support that empowers the ASPCA to be there for animals when they need us the most. In recognition of this generosity, Heroes Circle members enjoy special engagement opportunities, including:

- Personal contact within the ASPCA Philanthropy Department

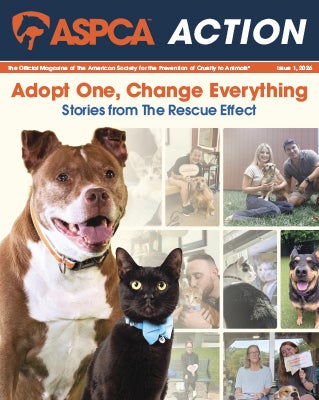

- ASPCA Action Magazine and ASPCA Calendar

- Opportunities for behind-the-scenes tours at our facilities

- Information sessions with senior-level animal welfare experts

- Recognition on the ASPCA Adoption Center donor wall (optional)

- Bi-annual reports showing the impact of Heroes Circle support

WAYS TO GIVE

Online

To give quickly and securely online, please click the “Donate” button below.

Mailed Donations

For expedited processing of your donation, please mail your check directly to:

ASPCA

Philanthropy Department

424 E 92nd St.

New York, NY 10128

If possible, please print, complete and mail this form with your donation.

Wire Transfer or Gifts of Stock

A donation of securities is a powerful way to support the lifesaving work of the ASPCA.

Please see instructions below for making a stock transfer to the ASPCA.

Stock Transfer Instructions

Merrill Lynch Account Number: 546-02087

Merrill Lynch DTC Number: 8862

ASPCA Federal Tax ID #: 13-1623829

For Credit to (Account Name):

ASPCA –American Society for the Prevention of Cruelty to Animals

Merrill Lynch Representative is:

Kevin J. McLaughlin, CPFA®

Managing Director, Wealth Management Advisor

Merrill Lynch, Pierce, Fenner & Smith Inc.

75 Rockefeller Plaza, 4th Floor

New York, NY 10019

Phone: (212) 415-7406

Fax: 212-553-2012

Prior to transfer, please call the Philanthropy team with name of stock and number of shares to be transferred.

Philanthropy Department

(646) 291-4517

[email protected]

For instructions on making a gift via wire transfers, please contact:

Philanthropy Department

(646) 291-4517

[email protected]

Donor-Advised Fund (DAF)

A donor-advised fund, or DAF, is a simple way to manage your charitable giving. Click here to learn more.

Qualified Charitable Distributions from an Individual Retirement Account (IRA)

If you plan on making a gift to charity this year, consider using your IRA.

Click here to learn more

The requirements:

- You must be 70 ½ or older when making a QCD.

- The gift, up to $100,000, must come from an IRA or Inherited IRA.

- The distribution must go directly from the financial institution to the charity.

The benefits:

- Unlike other IRA distributions, a QCD is not taxable income to you. This can result in tax savings even if you take the standard deduction on your federal tax return.

- A QCD can be used to satisfy all or part of your Required Minimum Distribution (RMD) each year. (Note: The age for RMDs was recently raised to 72, however, you may still make QCD gifts starting the year you turn 70 ½.)

Please send QCD gifts to the address below and include your name and address so that we can properly credit your gift.

ASPCA

Philanthropy Department

424 E. 92nd St.

New York, NY 10128

If needed, the ASPCA’s tax ID number is 13-1623829. If you have any questions about a QCD, contact our Philanthropy department at [email protected].

CONTACT US

If you have questions about the Heroes Circle, your giving or our work, please reach out to us. It would be a pleasure to speak with you.

Joey Teixeira

Senior Director of Philanthropy, Eastern Region

[email protected]

(646) 706-4640

Margo McAdams

Senior Director of Philanthropy, Western Region

[email protected]

(347) 749-7316

LEGAL INFORMATION AND TAX ID:

It is suggested that the following information be included with all gifts:

Name: American Society for the Prevention of Cruelty to Animals (ASPCA)

Principal Address: 424 East 92nd Street, New York, NY 10128

Telephone: (212) 876-7700

Federal Tax ID # 13-1623829

The American Society for the Prevention of Cruelty to Animals is recognized as a 501(c) 3 charitable organization by the Internal Revenue Service.

The material presented in this website is intended as general educational information on the topics discussed herein and should not be interpreted as legal, financial or tax advice. Please seek the specific advice of your tax advisor, attorney, and/or financial planner to discuss the application of these topics to your individual situation.

As an ASPCA®Heroes Circle member, you are a part of the nationwide work the ASPCA does every day to improve the lives of animals. The success of our efforts in rescuing, protecting and placing animals begins with dedicated friends like you, and we’re so grateful for your generous support.